Hindsight Bias – Seeing Unpredictable Events as Predictable

This describes the propensity for individuals to attribute more predictability to future occurrences than is really the case.

You could claim prescience about the winning side in a cricket match after seeing them win. In the course of their education, many high school and university students fall victim to hindsight bias.

Students often respond to the findings of research or experiments with an “of course” after reading them.

In other words, hindsight makes everything appear more plain and expected.

The effect of hindsight bias is clear here. Once the outcome is known, people tend to overestimate their capacity to have foreseen it.

The Reasons Why

Hindsight bias occurs when we revise our initial interpretation of an incident after learning additional knowledge about it.

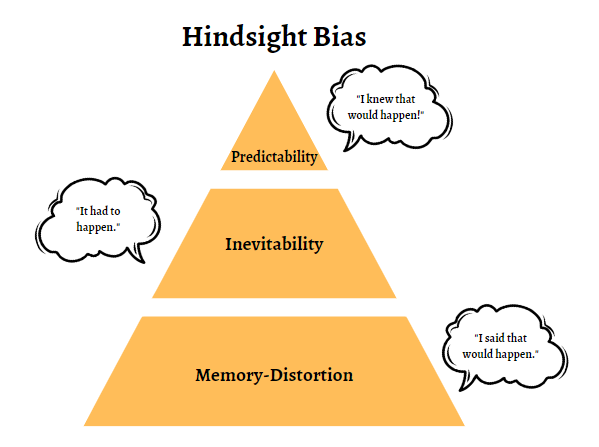

Psychologists Neal Roese and Kathleen Vohs claim that this may happen on one of three stacked levels.

- Memory distortion: It is the act of incorrectly recalling a prior evaluation or assessment. It’s a common ploy to take credit for a statement we didn’t make.

- Inevitability: The second stage is predicated on the idea that a certain historical incident was unavoidable.

- Foreseeability: The idea that we might have seen this coming. So, the bias arises when we recall our ideas incorrectly, attribute causality to an unforeseeable cause, and conclude that a foreseen outcome was possible.

Based on an examination of recent studies on hindsight bias, Roese and Vohs contend that three main categories of variables affect our propensity to overestimate our capacity for prediction:

- Cognitive biases: people tend to recall only the details that support their already beliefs about the past. Using the data at hand, we construct a narrative that makes sense. This process is called “sensemaking.” This is connected to the fallacy of confirmation.

- Metacognition – Thinking about our thinking is called metacognition. People often mistake ease for certainty while remembering and processing a prior decision or occurrence (an earlier cognition). The availability heuristic, at least in part, is responsible for the common perception that one knows how or why something occurred after the fact. This confirms our belief that this was predicated.

- Motivational: Believing that the universe is predictable and ordered gives us peace of mind. That might lead us to believe that the unexpected is rather regular. Feeling like you “knew it all along” or that your forecasts came true is a great perk, too. Studies have shown that our activities are often driven by an unconscious desire to reinforce a favourable self-perception.

Personal Repercussions

The problem of making the wrong choices can affect decisions. Assessing potential outcomes sensibly is an important part of decision-making. It may cause us to overestimate our capacity to foresee such outcomes. It seems to follow that we would overestimate our capacity to anticipate the repercussions of our future actions if we looked back on prior decisions and concluded that their effects were truly known to us at the time (when they weren’t). This is risky since it might cause us to overestimate our abilities and take foolish chances.

One example of a financial risk is investing too much of one’s money in a potentially volatile stock market.

One potential result of hindsight bias is victim blaming. Due to hindsight bias, onlookers frequently assume that the victim of a crime, accident, or other catastrophe “knew” what was going to happen and could have therefore prevented it.

Avoiding It

Hindsight bias may be overcome by contemplating and explaining other possible outcomes. Looking at a situation from every angle will make it appear less certain and predictable. We shouldn’t try to think of too many possible outcomes, since the decision-maker can mistake the difficulty of doing so for a sign that those scenarios are implausible.

Keeping track of prior choices and the predictions made about them is another strategy to deal with potentially harmful overconfidence. You may accomplish this by keeping a “decision journal,” which is like a diary except that it records your decisions and the thoughts you had at the time. To avoid fooling yourself into believing you knew it, keeping an unchangeable record of the forecasts related to your actions is essential.

Reference

https://thedecisionlab.com/biases/hindsight-bias

https://www.verywellmind.com/what-is-a-hindsight-bias-2795236