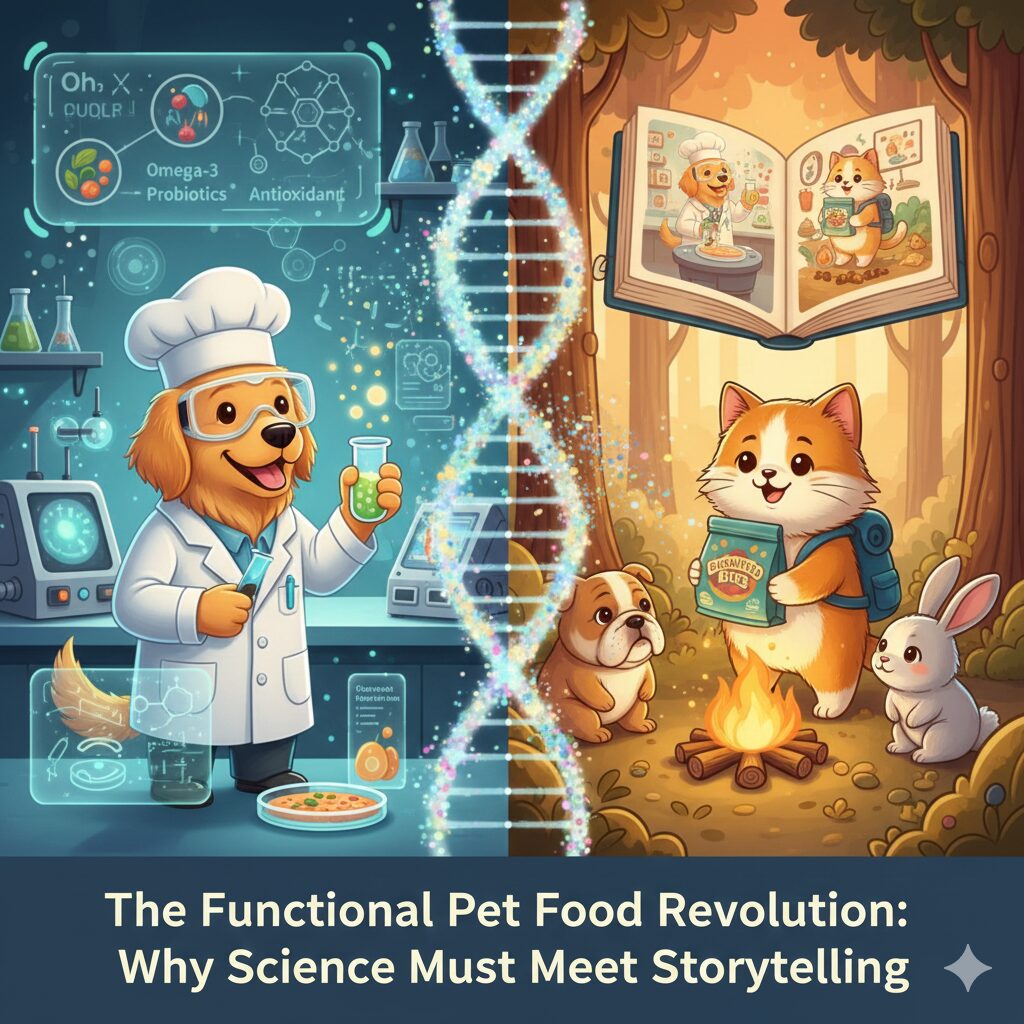

The Functional Pet Food Revolution: Why Science Must Meet Storytelling

Functional pet food is booming but confusing pet parents. Learn why science-backed education matters more than marketing hype.

Walk into any pet store today, and you’ll be overwhelmed. Joint health treats. Gut wellness kibble. Anxiety-reducing supplements. Probiotic chews. Even daily multivitamins for dogs.

The functional pet food category has exploded—and pet parents are more confused than ever.

The Boom Nobody Understands

Pet ownership has changed. Today’s pet parents don’t just feed their animals—they optimise their health like elite athletes. This shift has sparked a gold rush for products that promise benefits beyond basic nutrition.

The market is growing rapidly worldwide. From India’s emerging middle class to affluent Americans, pet owners are willing to pay premium prices for products that claim to improve their pets’ lives.

Global leaders such as Hill’s Science Diet and Royal Canin have built empires around functional nutrition. In India, brands like Drools and Pedigree now offer functional variants targeting local concerns—heat tolerance and digestive issues suited to Indian diets.

But explosive growth has brought explosive confusion.

Why Pet Parents Are Lost

The science is genuinely hard. Understanding how glucosamine supports cartilage and which probiotic strains affect gut health requires knowledge most people lack.

Marketing messages conflict. One brand says probiotics cure digestive issues. Another claims prevention. A third promises immune support. Same ingredient, three different stories. Who’s right?

Human health doesn’t translate. Pet owners assume turmeric works the same for their dog’s arthritis as it does for their own. It doesn’t. Pets metabolise differently, need different doses, and respond unpredictably.

Trust is broken. Products promising “miracles” and “quick fixes” create unrealistic expectations. When results don’t materialise, trust evaporates—and damages legitimate companies too.

At the core sits one question: Will this actually help my pet?

The Examples That Got It Right

Purina Pro Plan FortiFlora built credibility through veterinary channels and visible results. Pet owners see digestive improvements within days. That creates word-of-mouth marketing no ad budget can buy.

Royal Canin positioned itself through veterinarians, not retail shelves. By educating vets first, they ensured claims were professionally filtered before reaching consumers.

Himalaya Pet Wellness leveraged its century-old human health reputation. Indian consumers trust their Ayurvedic heritage, making the leap to pet products easier.

Fera Pet Organics, founded by a veterinarian, leads with brutal honesty: supplements support health; they don’t cure disease. This transparency builds lasting trust.

Education: The Only Path Forward

Stop selling. Start teaching.

What Works

Lead with benefits; explain science second. Don’t say “Contains glucosamine hydrochloride.” Say, “Helps ageing joints stay mobile—here’s how glucosamine supports cartilage.”

Set honest expectations. Supplements aren’t medicine. They don’t cure disease. They support normal function over time. This honesty sacrifices quick sales but builds long-term loyalty.

Show the difference: supplements vs. functional foods. Supplements deliver concentrated, targeted doses. Functional foods incorporate beneficial ingredients into daily diets. Both matter—for different reasons.

Prove it. Share clinical studies, not testimonials. Show third-party testing. Explain research methodology. Transparency signals confidence.

India’s Unique Challenge

India’s pet market faces distinct hurdles.

Many Indian pet owners are first-generation. They’re still learning the basics of nutrition—life-stage feeding, appropriate protein levels, and complete, balanced diets. Functional benefits come second.

Cultural factors help and hurt. Traditional use of turmeric, neem, and herbs creates openness to functional ingredients. But it also enables misinformation when products claim benefits without pet-specific research.

Price sensitivity matters. Why spend ₹2,000 on joint supplements when basic food costs ₹800? Education must demonstrate clear value.

Vet infrastructure is developing. Unlike Western markets, where vets drive nutrition decisions, Indian pet owners rely on shop owners, breeders, and online communities. Education must reach these influencers.

Indian Brands Rising

Heads Up for Tails invested in staff education so employees can explain products, not just sell them.

Wiggles creates content in multiple Indian languages to make complex nutrition accessible.

Dogsee Chew educates consumers about the dental benefits of Himalayan yak cheese, connecting traditional ingredients to modern health.

The Supplement Problem

Supplements are both an opportunity and a liability.

Unlike complete foods with established standards, supplements operate in a loosely regulated space. This enables innovation—and deception.

Pet parents bring expectations from human supplements. They’ve seen claims about energy, sleep, and cognition in human products. When they see similar claims for pets, they assume identical validation. Often wrong.

What Supplements Actually Do

They’re preventative, not curative. They work best when used consistently over time, not as emergency treatments.

Concentration matters. Supplements deliver therapeutic doses that functional foods can’t match.

Quality varies wildly. Chelated minerals absorb better. Different probiotic strains offer other benefits. Companies that explain these nuances build credibility.

Results take time. Joint supplements need 6-8 weeks. Probiotics may take days or weeks to work. Set expectations up front or lose customers.

The Future: Proof or Perish

The functional category will grow—but only for brands that deliver evidence.

Pet parents are done with vague claims. “Supports immune health” isn’t enough. They want specifics: What ingredient? What dosage? What evidence?

Winning Strategies

Real research. Commission clinical trials. Publish in peer-reviewed journals. Share data openly—including limitations and negative findings.

Partner with vets. Make them allies, not obstacles. Give them technical information to evaluate products confidently.

Clear language. Establish industry standards for claims. Define “supports joint health” precisely so consumers can make meaningful comparisons.

Digital education. Create videos showing how products work. Answer questions directly on social media. Build communities where pet parents learn together.

Back claims financially. Offer money-back guarantees. Financial commitment proves confidence.

Regulation Is Coming

As the category matures, oversight will tighten. Smart brands welcome this.

US: FDA and AAFCO provide oversight, but enforcement is inconsistent.

Europe: Stricter regulations already exist.

India: Framework still developing—opportunity for responsible self-regulation.

Companies adopting higher standards now become category leaders when regulations inevitably arrive.

Questions Pet Parents Should Ask

Navigating this landscape? Ask these:

Is there research? Look for clinical studies, not testimonials.

What’s the active ingredient and dosage? Vague lists aren’t enough.

How long for results? Realistic timelines vary by concern.

Who formulated this? Veterinary or nutritional expertise, or just marketing?

Supplement or functional food? Understand the role in your pet’s health plan.

What can’t this do? Companies stating limitations are more trustworthy.

The Bottom Line

When pet parents understand what they’re buying, everyone wins.

Pet owners make decisions that actually help rather than waste money on false promises.

Pets receive genuine support that improves their quality of life.

Legitimate brands differentiate from competitors and build lasting relationships.

The industry matures responsibly, establishing credibility for continued innovation.

The functional pet food revolution is inevitable. But its success depends on one thing: replacing confusion with clarity.

The companies that invest in education—that help consumers truly understand what they’re buying and why—won’t just survive this trend. They’ll define it.

Because pet parents don’t want to be sold to, they want partners in giving their animals the longest, healthiest lives possible.

That’s not just good ethics. It’s good business.