How Indian Gen Z is Transforming Shopping – And What It Means for the Next Generation

As Indian Gen Z continues redefining shopping behaviours, brands that evolve with them will win their wallets and loyalty.

India’s Gen Z aren’t just changing shopping habits—they’re rewriting the rules of brand engagement. Unlike previous generations who relied on TV commercials, newspaper ads, and word-of-mouth recommendations, today’s digital-first consumers discover products through social media, influencer endorsements, and interactive content.

However, simply catching their eye isn’t enough. Gen Z takes a thoughtful, research-backed approach to spending. They compare prices, scrutinise reviews, and seek social proof before purchasing. Traditional advertising alone won’t win them over—authenticity, transparency, and relevance matter.

Recent studies (conducted by some of my students) on Indian Gen Z consumers aged 13 to 24 highlight the key trends influencing their shopping behaviour. They offer a glimpse into how Gen Alpha (born after 2010) may further these trends.

1. Social Media is the New Storefront

For India’s Gen Z, shopping begins on social media. Over 54% of young consumers first discover products through digital platforms, making Instagram, YouTube, and WhatsApp Business their primary shopping guides. In contrast, traditional mediums such as television (12%) and physical stores (21%) have become less popular.

Among social media platforms:

- Instagram (61%) is the top choice for brand discovery.

- YouTube (52%) plays a significant role in showcasing product reviews and tutorials.

- Other short-video apps have some influence, particularly among users in Tier 2 and Tier 3 cities.

Example: Homegrown beauty brands like Sugar Cosmetics and Mamaearth have built massive traction by leveraging Instagram influencers and YouTube tutorials. Similarly, The Souled Store and Bewakoof use meme marketing and short-form content to drive engagement.

2. Ads That Feel Real Work Best

Gen Z doesn’t mind advertisements, but they must feel relatable and engaging. The best-performing ads show products in action, with:

- 34% of Gen Z say demo videos make them stop scrolling.

- 29% drawn in by music-driven content.

- 27% engaging more with humorous ads.

On the flip side, traditional marketing strategies are becoming less effective:

- Only 16% of Gen Z are influenced by Bollywood celebrity endorsements.

- IPL ads don’t hold long-term impact—63% forget them within a week.

What Works? Content that feels organic to each platform. For example, the fashion brand Urbanic grew its presence in India by focusing on user-generated content and influencer-led videos rather than high-budget commercials.

3. Research Before Spending is a Must

Despite their reputation for quick decision-making, Gen Z shoppers are highly research-driven. Before making a purchase, they:

- 78% read product comments and reviews.

- 74% visit the brand’s website for additional details.

- 70% check multiple sources to validate their choice.

Among the most trusted sources of information:

- Reviews on Amazon, Flipkart, and Nykaa significantly impact decision-making.

- Recommendations from friends (36%) and family (30%) carry more weight than influencer endorsements.

- Celebrity influence is minimal—only 13% say they trust celebrity-backed products.

Example: boAt, India’s leading audio brand, has skyrocketed in popularity by fostering strong social proof. It actively highlights customer testimonials and influencer reviews across Instagram and YouTube, making buying decisions easier for Gen Z consumers.

4. Price & Quality Matter More Than Brand Loyalty

For Indian Gen Z, affordability and quality drive purchasing decisions:

- 47% prioritise price visibility in ads.

- 42% focus on product quality.

- 38% demand transparency about ingredients and manufacturing.

Unlike previous generations, which stayed loyal to specific brands, today’s young shoppers are open to experimenting—as long as they find better value elsewhere. They also optimise their purchases by adding extra cart items to qualify for free shipping.

Where Do They Shop?

- Amazon & Flipkart remain the top online marketplaces.

- Meesho & GlowRoad are becoming popular for budget-conscious shoppers in smaller cities.

How Do They Pay?

- 41% prefer UPI apps like Google Pay, PhonePe, and Paytm.

- 35% use debit or credit cards.

- 24% still rely on parents to complete purchases.

5. Gen Alpha Will Expect Seamless Shopping Experiences

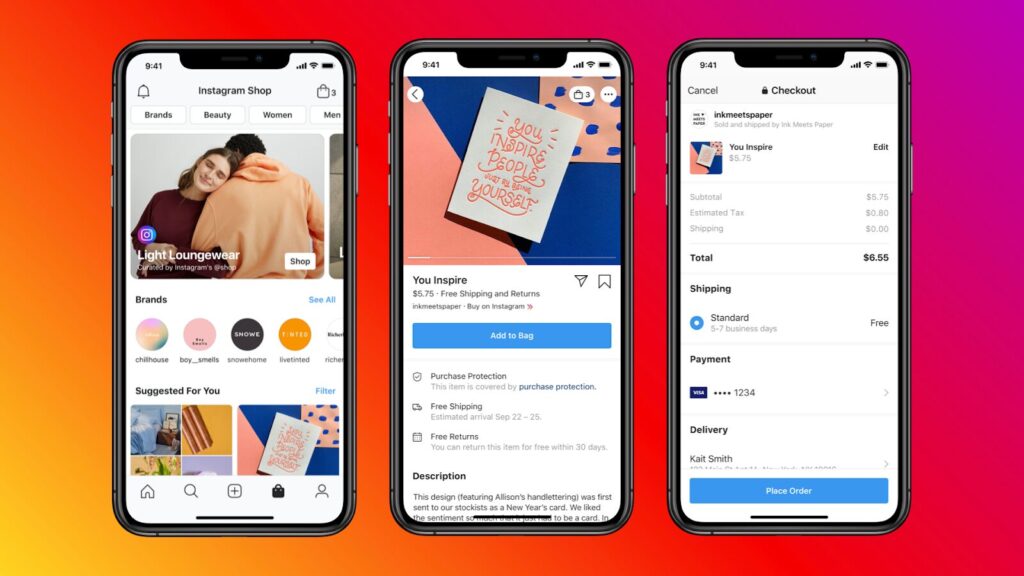

There’s a clear shift between younger and older Gen Z consumers that hints at what’s coming next. While older Gen Z (ages 20-24) still prefers traditional e-commerce websites, younger Gen Z (ages 13-15) are already comfortable shopping through social commerce platforms like Instagram Shops and WhatsApp Business.

As this trend continues, Gen Alpha (born after 2010) will likely push for even more integrated, frictionless shopping experiences where product discovery, social validation, and checkout happen within the same app.

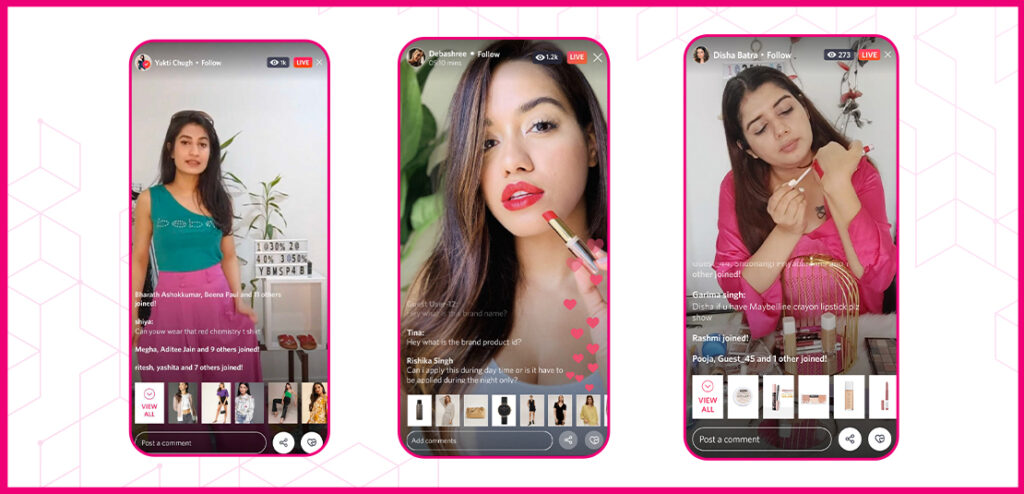

What’s Next? Platforms like Myntra and Nykaa are already experimenting with live shopping events, a trend heavily influenced by China’s booming social commerce industry. As Gen Alpha grows up in an even more digitally connected world, shopping will become more interactive, immersive, and instant.

Key Takeaways

India’s Gen Z aren’t just redefining shopping habits—they’re demanding a new level of brand transparency and engagement. To win their loyalty, brands must:

- Meet them where they are – platforms like Instagram, YouTube, and Moj are their go-to spaces for discovery and engagement.

- Showcase real value – transparent pricing, authentic customer feedback, and relatable storytelling matter more than flashy marketing.

- Encourage two-way interaction – Engaging through comments, DMs, and personalised responses strengthens brand connections.

- Build credibility over time – Gimmicks and influencer hype are ineffective; long-term trust necessitates consistency and authenticity.

- Simplify the shopping experience – Seamless checkouts, UPI payments, and easy WhatsApp ordering ensure a hassle-free buying journey.

As Indian Gen Z continues redefining shopping behaviours, brands that evolve with them will win their wallets and loyalty.