The Turnaround at Tiffany

The strategy that Bernard Arnault has adopted is straightforward but very profitable: he buys venerable but dated businesses like Tiffany’s and then modernises their administration, marketing and business practises.

Although the likes of Chanel, Hermès, and Loewe have flourished in Europe, the United States is home to just one luxury label: Tiffany & Co., established by jeweller Charles Lewis Tiffany in 1838. Despite the jewellery being crafted in some of the world’s most prestigious ateliers, it is well-recognised for having an American spirit of its own.

Charles Tiffany is largely credited with establishing the company’s image as a premium store via a series of unconventional business actions, such as marking the price of items to prevent bargaining and refusing to provide credit. The Tiffany mail-order catalogue’s cover, which he designed, has an iconic robin’s egg blue that he picked. During the Gilded Era, Tiffany & Co. became famous for their diamond engagement rings, and the company continued to thrive throughout the 20th century.

In 2013, Tiffany’s sales were above $4 billion. Yet, from that point on, negative issues began to occur. Tiffany’s biggest blunder was advertising their lower-priced pieces instead of their more expensive ones. Rather than being a high-end label, it has descended to that of a jewellery store.

In 2021, LVMH spent $16 billion to purchase the company. Then things started to turn around.

Several different plans were put into motion to restore its former splendour.

- Aim for a different demographic

Affluent retirees and vacationers accounted for the bulk of Tiffany’s business. Younger people no longer saw it as something to strive towards. With the new playbook, Gen Z and Millennials were singled out for special attention.

Unlike earlier administrations, which ushered in changes gradually and avoided the spotlight for fear of watering down the premium brand, the current team takes a more outspoken stance on matters of taste. Tiffany created a fresh strategy to appeal to millennials and members of Generation Z.

- Original and novel merchandise

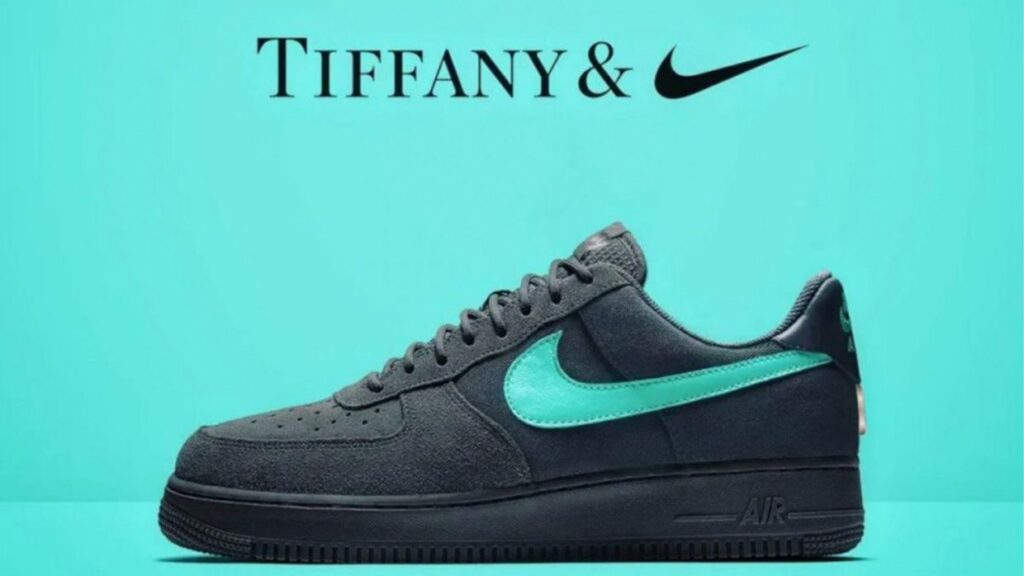

NFTs, TiffCoins (limited-edition gold coins that grant holders access to exclusive events), a wildly successful unisex “lock” bracelet collection priced affordably enough to attract new customers, and buzzy collaborations with Patek Philippe, Supreme, Nike, and the upstart art collective Mschf (who created a $1,000 limited-edition Ultimate Participation Trophy with the jeweller) are just a few examples of Tiffany’s innovative marketing strategies. Tiffany collaborated with modern artist Daniel Arsham on a series of sculptures, and with Wilson on a blue football and basketball.

Having a voice in popular culture is a prerequisite to gaining social status. Before LVMH acquired Tiffany, sales had been declining, especially among young, wealthy buyers. Several factors contributed to this downturn, including a general dip in marriage and decreased spending by tourists. A more systemic issue was that Tiffany was losing cachet among millennials in comparison to other luxury brands, particularly European ones like Louis Vuitton, Gucci etc.

To be an American is to value diversity and democracy. Even as a premium brand, the product became more readily available to the public. To reach a wider market, the company had to introduce lower-priced items like $350 silver heart necklaces and form partnerships with mass-appeal companies like Nike, but it also had to highlight its commitment to quality workmanship and high-end jewellery. The company was also aware of the need of projecting an approachable and inclusive public persona.

“No rules, everyone welcome“ was Tiffany’s slogan when the company debuted its range of gender-neutral lock bracelets in August of last year. That’s the American way of thinking: catering to customers of all ages and financial means.

- A Change in Marketing Tactics

Rather than continuing with its previous, dated marketing strategy, Tiffany has shifted its focus to attracting a younger demographic by way of celebrity endorsements and social media, and by emphasising the luxury credentials of its products.

Consider Beyoncé and Jay-Tiffany Z’s endorsement.

Beyoncé and Jay-debut Z’s Tiffany ad made many fantasise about a modern remake of the classic Breakfast at Tiffany’s. It featured the recently acquired artwork “Equals Pi” by Jean-Michel Basquiat for LVMH. There was a huge controversy on the internet when people noticed the striking similarity between the painting’s background and the trademark colour.

The early marketing campaign “Not Your Mother’s Tiffany” was a flop because it went against the commonplace notion that jewellery is passed down through generations. Teenagers, who could have purchased silver mom heart bracelets for cheap, didn’t feel welcome.

However, once the “Not Your Mother’s Tiffany” ad ended, silver goods sales skyrocketed. The hype encouraged those who weren’t acquainted with Tiffany before to take part.

Outcome

Tiffany has been the company most responsible for LVMH’s expansion over the previous two years. Jewellery and watch sales for LVMH increased 18% to $11.35 billion in 2022, with Tiffany’s contribution doubling from its pre-acquisition level.

Reference

https://www.fastcompany.com/90850466/tiffany-brand-turnaround-lvmh-alexandre-arnault