Why India’s Pet Care Industry is Going to Get Bigger

Discover why India’s booming pet care industry is attracting global investors like Nestlé. Learn about the trends, market potential, and opportunities in the Indian pet food and pet care sector.

A few years ago, pet care in India was simple—homemade food, a bowl of milk, and maybe a quick visit to the vet when necessary. Fast forward to today, and pets are no longer just animals we care for—they’re full-fledged family members. And just like any loved one, we’re spending more on their health, food, comfort, and even entertainment.

So when a global giant like Nestlé invests in Drools Pet Food, it’s not just a business decision—it’s a statement. The Indian pet care industry is heating up, and everyone wants a piece of it.

Let’s take a closer look at what’s driving this pet-powered boom.

Pets Are the New Family

Pet ownership in India is rising fast. Urban nuclear families, millennials, and even older adults are bringing pets into their lives—not just as animals, but as companions. The emotional connection between humans and pets is driving a new wave of spending and lifestyle changes.

During COVID-19, this trend accelerated. With more time at home, people adopted pets for emotional support, leading to an increase in demand for pet food, grooming, and veterinary care.

The Pet Economy Is Getting Serious

It’s no longer about feeding your dog leftovers. Today’s pet parents are searching for premium dog food, grain-free kibble, nutritious treats, and pet-safe skincare. Pet grooming services, birthday parties, and even online vet consultations are becoming common.

In short, pet care has gone premium.

Why Investors Are Wagging Their Tails

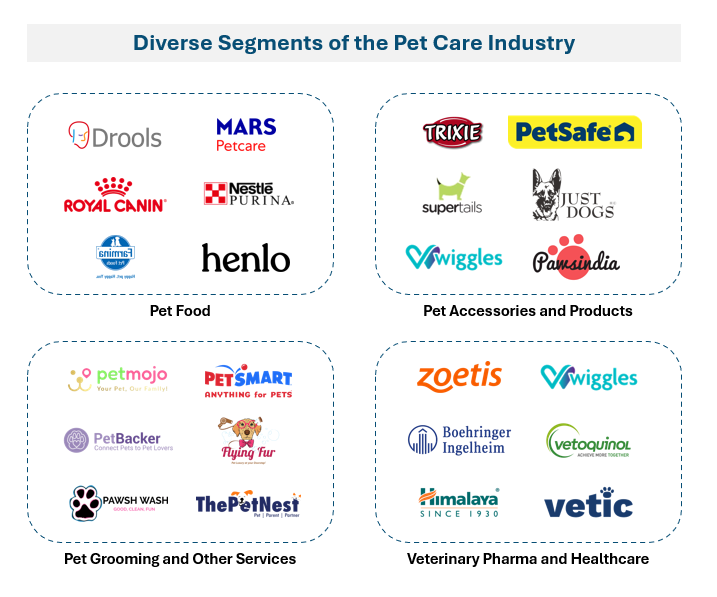

The Indian pet care sector is catching the eye of both global giants and domestic startups. Here’s why:

- High growth potential: With over 30 million pets in India, and a rapid growth rate.

- Untapped market: Branded pet food and products still account for a small share, offering immense growth potential.

- Tier 2 & Tier 3 expansion: Pet care demand is expanding beyond metros, driven by rising incomes and increased awareness.

- Digital-first disruption: Platforms like Heads Up For Tails, Supertails, and Wiggles are leading with D2C models and personalised services.

Nestlé’s minority stake in Drools Pet Food—a company also backed by L Catterton’s $60 million investment—is a clear sign of confidence in this ecosystem.

The Gaps: A Market Still Finding Its Paws

Despite the momentum, the Indian pet care industry still faces significant gaps—and they represent untapped potential:

- Pet medicines and supplements remain a fragmented market, characterised by inconsistent quality and limited availability outside urban areas.

- Accessories and toys are often imported or overpriced, lacking locally manufactured, affordable options tailored to Indian pets and climates.

- Veterinary access remains limited in Tier 2 and 3 cities, where trained professionals and advanced diagnostics are scarce.

- Pet insurance and preventive health products are in their infancy.

- Awareness and education around pet nutrition, mental stimulation, and hygiene are still evolving.

That’s Why Leading Indian Companies Are Stepping In

- Godrej Consumer Products launched Ninja, a pet-focused brand offering grooming essentials and hygiene products.

- Mankind Pharma has also entered the segment, with veterinary medicines and pet health products.

- Heads Up For Tails (HUFT) has grown into a premium lifestyle brand for pets—selling everything from gourmet treats to customized collars, even spa services.

- Supertails and Wiggles are addressing healthcare, training, and wellness, building full-stack pet care platforms.

India’s Pet Care Future: More Than Just Food

From nutritious meals and grooming kits to tech-enabled pet health, the future is full of possibilities. The brands that succeed will be those who look beyond products to build relationships with pet parents, offering value, trust, and emotional resonance.

As Indians increasingly treat their pets like children, the pet care industry will evolve to mirror the baby care, healthcare, and FMCG industries—with similar levels of brand loyalty and emotional investment.

Conclusion

India’s pet care revolution is more than just a trend—it’s a transformation. And for entrepreneurs, brands, and investors, it’s the perfect time to sit up, take notice, and be part of a market where tails are wagging and wallets are opening.