Young Pet Parents Are Redefining How India Buys for Pets

Young Indian pet parents are reshaping petcare buying through social platforms, influencer trust, and education-led digital commerce.

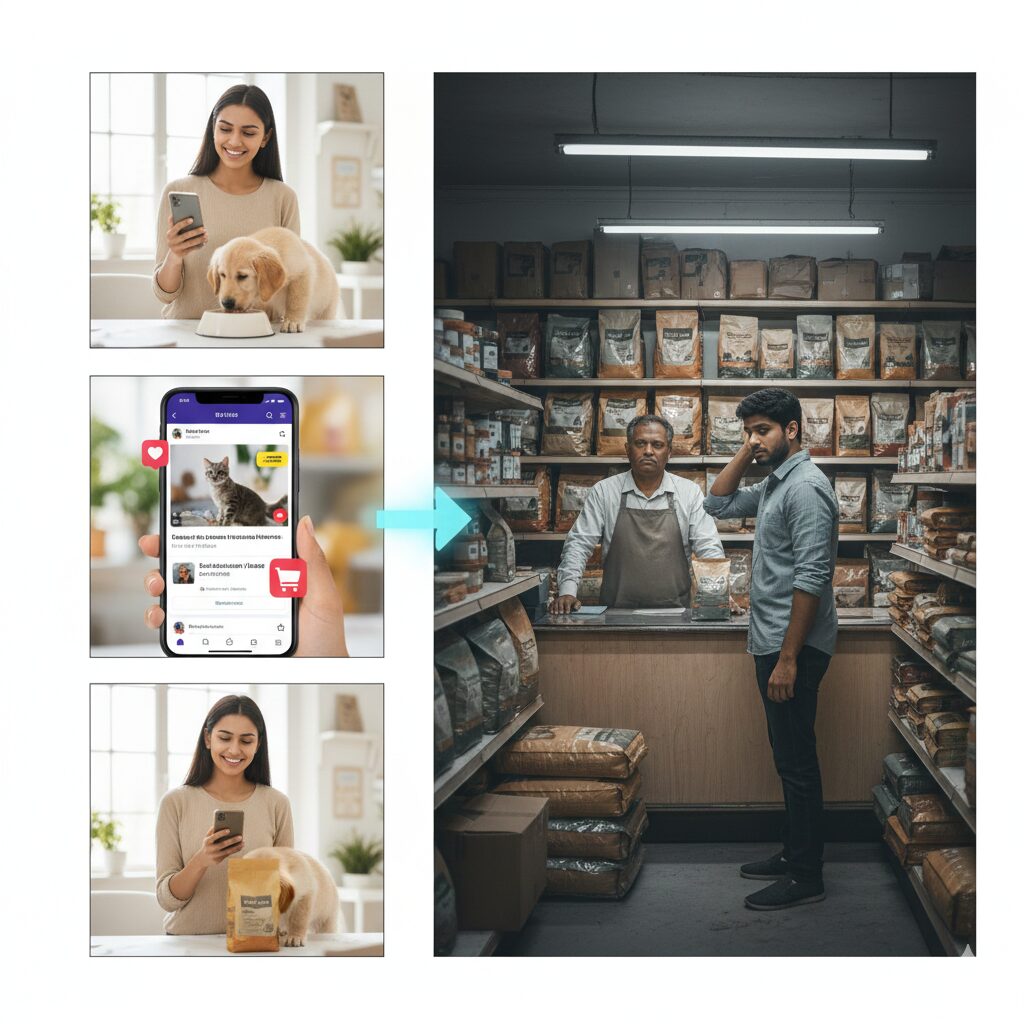

India’s petcare market is being quietly reshaped – not in pet shops or vet clinics, but on social media feeds.

According to recent industry observations, Millennials and Gen Z are fundamentally changing how pet products are discovered, evaluated, and purchased. For this cohort, social platforms are no longer places to browse content – they are fast becoming environments for decision-making and commerce.

While overall pet ownership growth has moderated in some global markets, India is witnessing a demographic shift that matters far more than raw numbers. Younger, urban pet parents – often first-time owners – are entering the category with very different expectations. They are research-heavy, brand-curious, and far more influenced by peer content than traditional advertising.

From Discovery to Purchase – All on Social

Previously, the pet care buying journey was fragmented. Discovery happened on social media, consideration on marketplaces, and purchase on brand websites or pet stores.

That line is now blurring.

Platforms like Instagram have evolved into integrated ecosystems where discovery, validation, and purchase intent happen almost simultaneously. Short videos, reviews, before-and-after transformations, and routine-led content are shaping how pet parents evaluate products-especially food, supplements, grooming aids, and wellness solutions.

For Indian pet parents, this matters because many are still learning the basics: what to feed, how often, and which products are genuinely beneficial. Social content fills this education gap far more effectively than static ads or shelf labels.

The Rise of Pet Creators and Everyday Experts

One of the most significant shifts is the growing influence of pet creators – everyday dog and cat parents who document routines, trials, mistakes, and wins.

Unlike celebrity endorsements, these creators feel relatable. Their homes look familiar. Their pets feel real. Their recommendations don’t sound scripted.

Indian pet brands are increasingly collaborating with such creators to:

- Demonstrate product usage in real-life settings

- Explain why a product is used, not just what it claims

- Build trust around sensitive categories like supplements and functional nutrition

This content doesn’t just drive awareness. It shortens decision-making time and reduces hesitation, two critical barriers to pet care purchases.

Why This Matters for Petcare Brands in India

For brands, this shift signals a vital truth: marketing and commerce are no longer separate functions.

Younger pet parents expect:

- Education before promotion

- Transparency over exaggeration

- Proof over promises

Social platforms, when used well, deliver all three.

Industry data suggests that engagement-led social commerce often results in lower customer acquisition costs and stronger repeat behaviour than traditional digital advertising, particularly in trust-heavy categories like pet food, supplements, and wellness.

The Bigger Shift

What we’re seeing isn’t just a channel change. It’s a mindset change.

Young Indian pet parents don’t want to be sold to.

They want to understand.

They want reassurance.

They want to see products work in lives that look like theirs.

Brands that recognise social platforms as spaces for education, community, and credibility – not just promotion- will be the ones that win this next phase of petcare growth.

In India’s evolving pet economy, influence is no longer about reach.

It’s about relatability, trust, and usefulness.

And that changes everything.

Bibliography

- India’s Pet Care Economy 2025: Market Trends, Key Players, and Growth Opportunities – overview of India’s expanding petcare market and rising spend driven by younger and urban pet parents. India Briefing.

https://www.india-briefing.com/news/indias-pet-care-economy-2025-an-overview-37234.html (India Briefing) - Decoding the Rise of the Pet Care Industry in India: A New Consumer Growth Story – data on India’s petcare market size, growth projections, premiumisation and the role of digital channels and social engagement in marketing. India Brand Equity Foundation (IBEF).

https://www.ibef.org/blogs/decoding-the-rise-of-the-pet-care-industry-in-india-a-new-consumer-growth-story (India Brand Equity Foundation) - Younger pet owners reshape purchasing through social platforms – coverage of generational shifts in pet product discovery and social platform commerce influence (original report referenced in global industry context).

https://www.petfoodindustry.com/business-strategy/article/15801081/younger-pet-owners-reshape-purchasing-through-social-platforms (PetfoodIndustry) - Pet Fed India – example of growing pet community events that reflect lifestyle and cultural shifts among younger pet owners in India. Wikipedia article.

https://en.wikipedia.org/wiki/Pet_Fed_India (Wikipedia) - India Pet Humanization Insights 2024 | Consumer Behavior – pet humanisation trend in India showing emotional attachment and engagement levels among owners (including younger demographics). TGM Research report summary.

https://tgmresearch.com/pet-humanization-report-india.html (tgmresearch.com)